As the largest community in Citrus County, Homosassa Springs has over 14,000 residents. So it has a modest real estate market that is comprised of a number of rental properties. If you’re buying or selling a home in the area, you can quickly learn the value of any residential property by ordering our comparative market analysis-based U.S. Home Value Report.

Find Out the Value of a Homosassa Springs Home

For residential property with a maximum of two family units.

Single-Family Homes • Condominiums • Townhomes • Duplexes

Homosassa Springs Appraisal Emulations

U.S. Home Value Reports are available to real estate investors, homebuyers, and homeowners that want to learn how much a house is worth without having to interact with a real estate agent or spend hundreds of dollars on an appraisal. Our real estate CMA-based report is intended to estimate or emulate how much a Homosassa appraiser would likely value a particular subject property.

We Estimate Home Values in the Following Areas:

Neighborhoods: Town Center, Sugarmill Woods, Oak Village at Sugarmill Woods, Cypress Village at Sugarmill Woods, Chassahowitzka / Ozello, Homosassa Springs North, Homosassa Springs, and Homosassa Springs South.

Zip Codes: 34446, 34448, and 34461.

Homosassa Springs Property Appraisal Resources

Government Offices

Citrus County Property Appraiser

Appraisers

Real Estate Appraiser Licensee Search

Real Estate Agents

https://www.realtor.com/realestateagents/homosassa-springs_fl

Our Appraisal Emulation Process

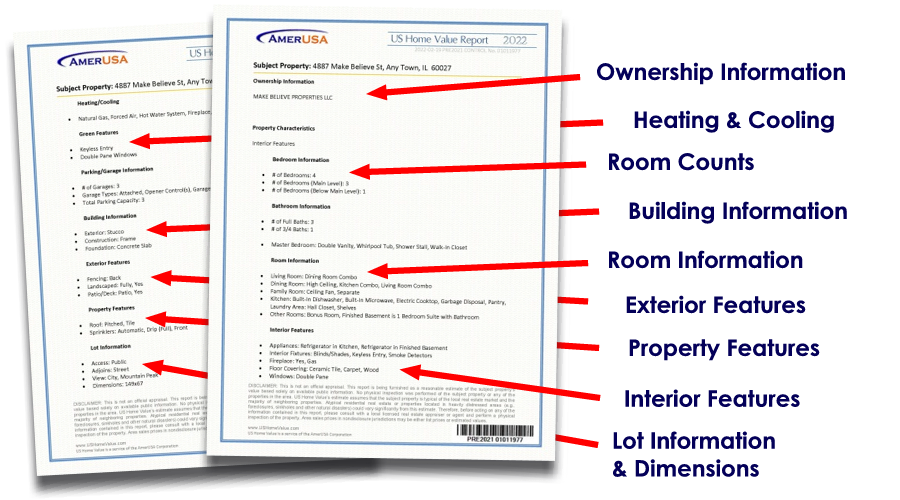

Each U.S. Home Value Report is produced by a highly skilled valuation processor that manually researches and assesses the market value of your subject property. Because our reports are performed by experienced professionals – as opposed to algorithms relying invalid living areas and property characteristics – this enables us to maintain a low margin of error. Here’s an overview of our process:

Step 1. Property Questionnaire

The first step involves asking if any improvements have been made or if there are any significant repairs needed. Adding a new bedroom or failing to update an old kitchen could have a substantial impact on a home’s value.

Step 2. Subject Property Research

Using a number of private and government resources, our processor will retrieve all of the relevant data about the subject property, including its living area, rooms, lot, amenities, etc.

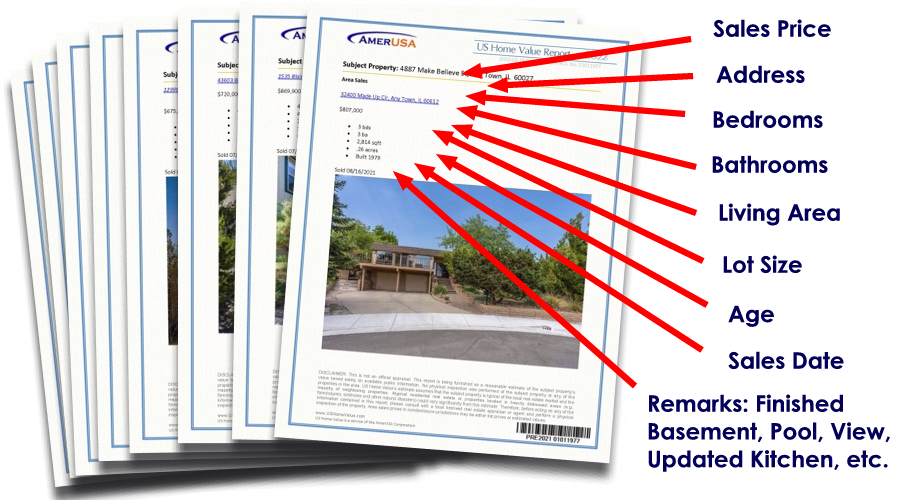

Step 3. Comparable Properties Search

In order to perform the next step, a comparative market analysis, our processor must locate a minimum of five comparable properties known as “sales comps.” These are homes that have recently sold in the local area that share similar characteristics with the subject property.

Step 4. Comparative Market Analysis

The second to last step requires a valuation processor to perform a comparative market analysis (also known as a real estate CMA) by analyzing each comparable property and comparing it against the subject property to formulate an opinion of its estimated value.