Situated on the Manatee River, the City of Bradenton has over 60,000 residents and a housing market that has fully recovered and more than doubled in value since the Great Recession. If you’re looking to purchase or sell a primary residence or investment property, do your own independent research and order a fast and affordable appraisal emulation featuring our comparative market analysis-based U.S. Home Value Report.

Find Out the Value of a Bradenton Home

For residential property with a maximum of two family units.

Single-Family Homes • Condominiums • Townhomes • Duplexes

Bradenton Appraisal Emulations

U.S. Home Value Reports are available to real estate investors, homebuyers, and homeowners that want to learn how much a house is worth without having to interact with a real estate agent or spend hundreds of dollars on an appraisal. Our real estate CMA-based report is intended to estimate or emulate how much a Bradenton appraiser would likely value a particular subject property.

We Estimate Home Values in the Following Areas:

Neighborhoods: Bayshore Gardens, El Conquistador, Hawks Harbor, Preserve at Panther Ridge, Lakewood Ranch, Del Webb, Rosedale / Serenity Creek,Esplanade / Central Park, Pomello Park, River Club South / Riverwalk Village, Riverview Blvd, Wilton Crescent / University Place, Winding River / Mill Creek, and Whitfield Estates.

Zip Codes: 34201, 34202, 34203, 34204, 34205, 34206, 34207, 34208, 34209, 34210, 34211, 34212, 34280, 34281, and 34282.

Bradenton Property Appraisal Resources

Government Offices

Manatee County Property Appraiser

Appraisers

Real Estate Appraiser Licensee Search

Real Estate Agents

https://www.realtor.com/realestateagents/tallahassee_fl

Our Appraisal Emulation Process

Each U.S. Home Value Report is produced by a highly skilled valuation processor that manually researches and assesses the market value of your subject property. Because our reports are performed by experienced professionals – as opposed to algorithms relying invalid living areas and property characteristics – this enables us to maintain a low margin of error. Here’s an overview of our process:

Step 1. Property Questionnaire

The first step involves asking if any improvements have been made or if there are any significant repairs needed. Adding a new bedroom or failing to update an old kitchen could have a substantial impact on a home’s value.

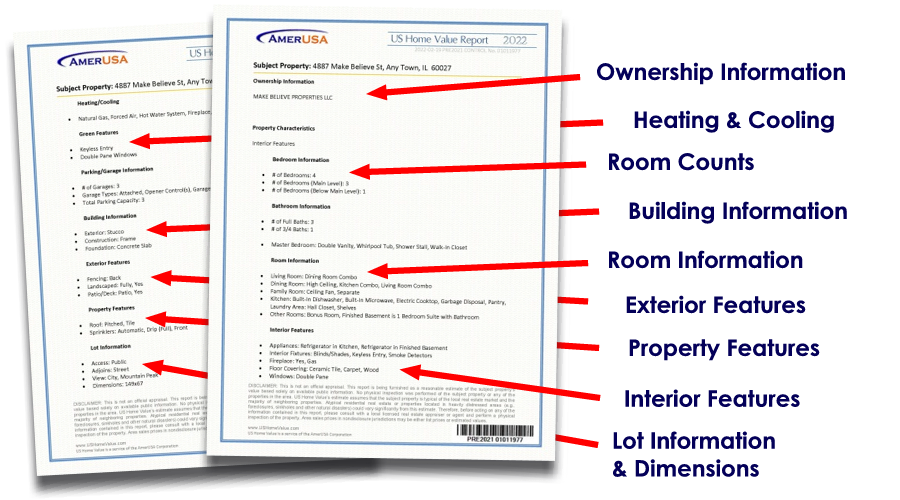

Step 2. Subject Property Research

Using a number of private and government resources, our processor will retrieve all of the relevant data about the subject property, including its living area, rooms, lot, amenities, etc.

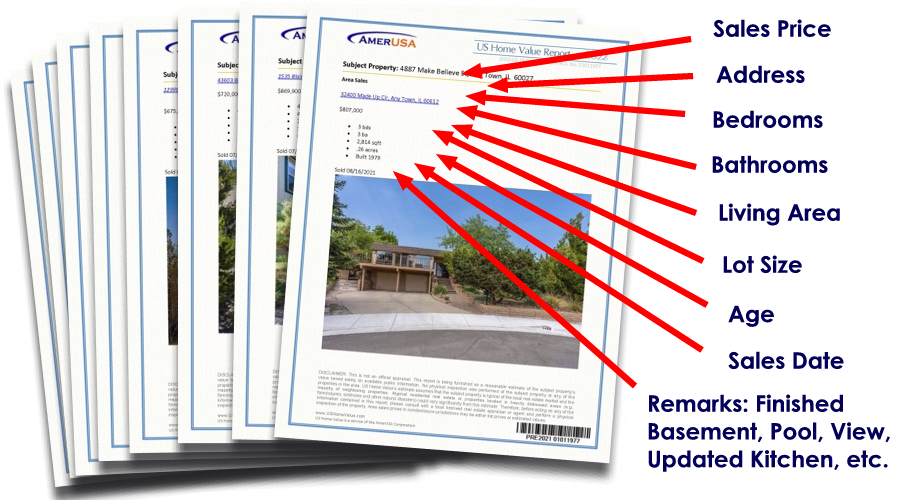

Step 3. Comparable Properties Search

In order to perform the next step, a comparative market analysis, our processor must locate a minimum of five comparable properties known as “sales comps.” These are homes that have recently sold in the local area that share similar characteristics with the subject property.

Step 4. Comparative Market Analysis

The second to last step requires a valuation processor to perform a comparative market analysis (also known as a real estate CMA) by analyzing each comparable property and comparing it against the subject property to formulate an opinion of its estimated value.